MA Money

Growth Unlocked With RMBS Public Term Issuance Success

MA Money, a rapidly growing residential mortgage lender successfully completed its first Residential Mortgage-Backed Securities (RMBS) public term issuance, amounting to $500 million. To fulfill the regulatory requirements for the RMBS issuance and to fuel MA Money’s growth plans, Data Army was engaged to deliver a modern data solution with a focus on data quality and integrity.

INDUSTRY:

Finance

TECH:

dbt Labs, Snowflake, Azure Data Factory, Azure Data Lake Storage

OVERVIEW

Established in 2004, MA Money is a non-bank mortgage lender that specialises in residential mortgages for those who do not meet the lending criteria of mainstream lenders. MA Money has a history that includes business acquisitions and rapid growth fuelled by accelerated sales. This history has left a fragmented data environment, with legacy platforms, and non-uniform data pipelines and files containing vital information for analysis by internal and external parties.

To leverage the data assets MA Money has available, several key challenges had to be addressed:

- The demand for exceptionally high data accuracy, and is a requirement for MA Money’s inaugural Residential Mortgage-Backed Security public term issuance.

- Providing analysis and insights to investors globally and navigating multiple regulatory jurisdictions.

- Stringent delivery timelines, with a tight six-week window to accomplish these critical tasks.

MA Money’s preferred choice was Data Army for several reasons:

- Crucial expertise in information modelling and testing, vital for the success of this project.

- The advantage of high innovation and swift decision-making inherent in working with a small to medium enterprise consultancy, coupled with direct engagement with the principal consultant.

- Data Army’s willingness to embed their team into MA Money’s Agile scrum framework.

- Data Army is highly regarded with a proven track record of delivery, a strong team and proven processes.

- Data Army’s commitment to prioritising client needs and delivering successful outcomes.

Business Objectives

Data Army was engaged to deliver a project to meet MA Money’s key objectives:

- Using existing cloud infrastructure, including Microsoft Azure, the Snowflake data cloud, and Tableau, develop a self-serve analytics platform tracking mortgage data for use within MA Money’s Treasury department and by MA Money external parties.

- Complete the development within a constrained timeline.

- Implement a test suite that proactively alerts MA Money of potential issues to reduce the chance of poor information quality or historical data remediation events.

“My positive perception of Data Army, coupled with a strong track record and proven processes, made working with them an easy decision.

What I specifically anticipated—and indeed experienced—was a high level of innovation and quick decision-making. Working with a smaller outfit like Data Army allowed for direct engagement with the principal consultant, avoiding the inherent bureaucracies often associated with larger consultancies.

The outcomes were impressive:

- The pace of delivery was exceptionally rapid, with an incredibly low cost to implement changes.

- We achieved an extensive volume of high-quality tests at a low cost, making it easy to introduce or refactor tests as needed.

- The engagement process, billing, and operations ran smoothly with minimal friction.

- The direct embedding of Data Army team members into our Agile team further streamlined collaboration.”

– Sanjay Patel, Head of Data (Consultant), MA Money

PROJECT OUTCOMES

- MA Money technology team can actively monitor and action incoming data anomalies.

- Data can be retrieved and landed in the platform with an extensible and configuration driven data retrieval solution for collecting data from multiple source systems.

- Data transformations within the solution use industry best-practice with quality assurance built into to each stage.

- MA Money met the data integrity requirements for a Residential Mortgage-Backed Security public issuance.

- MA Money can manage the solution with in-house resources.

THE DATA ARMY SOLUTION

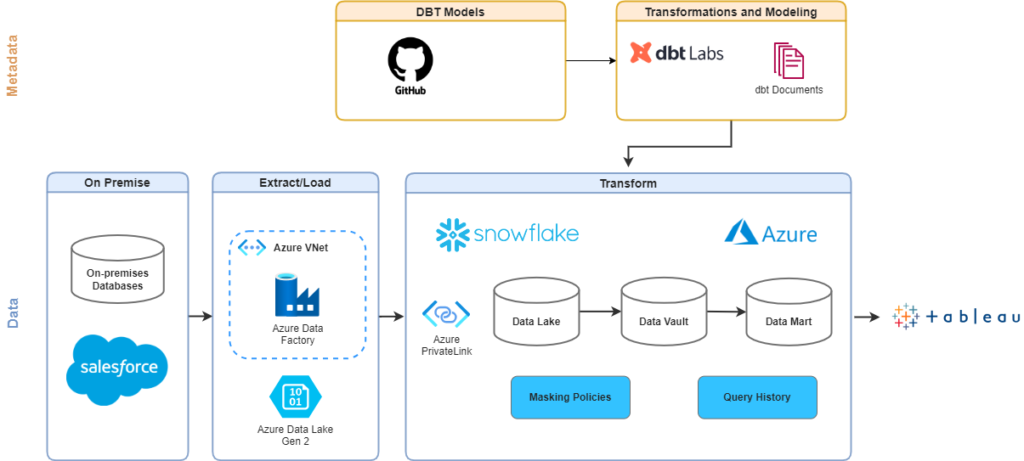

The solution involved:

- Data retrieval and ingestion using Azure Data Factory (ADF)

- Configuration-based with schema evolution on tables.

- Data staging on Azure Data Lake Gen 2 blob storage.

- Snowflake used for the Data Lake, Data Warehouse and Data Mart.

- dbt Cloud on Snowflake

- Tests executed by dbt on scheduled runs.

- Live tests result of Snowflake views and exposed via Tableau.

- Tableau querying Snowflake for self-service analytics and business intelligence

As the project progressed, it became necessary to increase test coverage across certain aspects of the operations processes.

This helped move information checks further up the sales pipeline and prevented data quality issues.

Working alongside MA Money’s internal technology teams, Data Army assisted in:

- Building custom queries and tests to identify data that needed to be historically remediated by reviewing the primary source information (e.g. documents).

- Building near real-time validation views in Snowflake that supported identification of operational processes that have led to inconsistent data state and could alert relevant staff as they occur.

Want to understand how we can help your business with your data needs?

Contact us to book your initial consultation.